Is $500 Enough to Trade Forex?

Introduction

Entering the forex (foreign exchange) market promises an enticing venture for many aspiring traders, drawing them towards its high liquidity and 24-hour trading opportunities. With the global forex market’s vast landscape, beginners often ponder whether an initial investment as modest as $500 is sufficient to embark on this financial journey. This introductory segment delves into the foundational aspects of forex trading, setting the stage for a comprehensive exploration of whether a $500 investment can effectively serve as a stepping stone within the world's largest financial market.

Forex trading, at its core, involves the simultaneous buying of one currency and selling of another, with the hope of profiting from fluctuations in exchange rates. The allure of forex lies in its accessibility; it is a market that accommodates participants from individual retail traders to major financial institutions, all of whom are drawn by the potential for profit and the excitement of the trade. However, amidst this allure, the forex market is fraught with challenges and complexities that demand a thorough understanding and strategic approach, especially for those with limited starting capital.

The question of whether $500 is enough to engage in forex trading is not merely a matter of financial capability but also involves considerations of risk management, leverage, and the trader's skill level. For newcomers, navigating the forex market can seem daunting, with terms like "pips," "lots," "leverage," and "margin" forming the unique lexicon of this financial world. Understanding these terms and the mechanics of forex trades is crucial in assessing how far a $500 investment can go in pursuit of trading success.

Moreover, the psychological aspect of trading cannot be underestimated. The emotional discipline required to make judicious decisions under the pressure of fluctuating market conditions is a pivotal factor that influences trading outcomes. This becomes even more pronounced when trading with a relatively small amount of capital, where the temptation to over-leverage in pursuit of larger gains can lead to significant losses.

As we peel back the layers of forex trading dynamics in this series, we aim to provide valuable insights and strategies for maximizing the potential of a $500 investment. By combining diligent market analysis, risk management practices, and an understanding of leverage and margin requirements, traders can approach the forex market with confidence, even with limited initial capital.

In the forthcoming section titled "Understanding Forex Trading," we will explore the fundamental concepts and mechanisms of the forex market in greater detail. This exploration will serve as the foundation for discerning how a novice trader with $500 can navigate the complexities of forex trading, laying down a strategic framework for potential success in this vibrant and ever-changing financial arena.

Understanding Forex Trading

Forex trading, an arena often perceived as complex and precarious, requires a nuanced understanding to navigate effectively. At its core, Forex, or foreign exchange market, is the global marketplace for trading national currencies against one another. Its vast terrain, marked by high liquidity and 24-hour operation during weekdays, offers a unique set of opportunities and challenges for traders. This deep dive seeks to elucidate the key facets of Forex trading, providing a sturdy foundation for novices and a refresher for seasoned traders.

The Market's Mechanisms

Forex trading operates on the principle of buying one currency while simultaneously selling another. This duality is encapsulated in what is known as a currency pair, which serves as the cornerstone of Forex trades. For instance, the EUR/USD pair, one of the most traded pairs, reflects the value of the euro relative to the US dollar. The price associated with a currency pair is indicative of how much of the quote currency (USD in this case) is required to purchase one unit of the base currency (EUR).

Traders must stay abreast of factors that could sway currency values, such as economic indicators, political events, and market sentiment. These variables can cause the Forex market to fluctuate rapidly, presenting both profit opportunities and risks.

Leverage: A Double-Edged Sword

A distinctive feature of Forex trading is the use of leverage. Leverage allows traders to control a large position with a relatively small amount of capital. For example, with a 100:1 leverage, one can control a position of $100,000 with just $1,000. While leverage amplifies potential profits, it also escalates potential losses, making it imperative for traders to use it judiciously and to be mindful of their risk management strategies.

The Role of Brokers

Forex brokers act as intermediaries between individual traders and the vast Forex market. When selecting a broker, traders should consider factors such as regulation, spreads, leverage options, and the platform's user interface. A reputable broker will provide access to the best available prices, execute trades swiftly, and offer educational resources to aid traders in refining their strategies.

Analysis: Technical and Fundamental

Successful Forex trading hinges on effective analysis to forecast market movements. Technical analysis involves the study of price charts and historical data to identify patterns and trends that may hint at future price movements. Conversely, fundamental analysis assesses economic indicators, central bank policies, and political events to predict currency value changes. While each method has its proponents, many traders find that a combination of both techniques yields the best results.

Embracing Volatility

Volatility is a hallmark of the Forex market, attributed to various factors ranging from geopolitical developments to changes in economic data. While volatility can unsettle the unprepared, it is the lifeblood of the Forex market, creating opportunities for traders to profit from price movements. However, harnessing volatility demands a clear strategy, a calm demeanor, and a disciplined approach to risk management.

In summary, understanding Forex trading is fundamental to navigating its turbulent waters. By grasping the market's mechanisms, leveraging cautiously, choosing the right broker, employing thorough analysis, and embracing volatility, traders can position themselves to capitalize on the opportunities that Forex trading presents. As we transition to the next part of our series, "The Role of $500 in Forex Trading", we will explore how a seemingly modest sum can serve as a gateway to the vast Forex market, underlining the importance of strategic approaches and prudent capital allocation.

The Role of $500 in Forex Trading

In the realm of Forex trading, the question of how much capital is required to not only enter the market but to also make a tangible profit is one of immense importance. The role of $500 in Forex trading, to some, might seem insignificant at first glance. However, to a well-informed trader, this amount is a gateway to myriad opportunities within the global currency markets. This section delves into the strategic potential of a $500 investment, demystifying the dynamics of leverage, risk management, and growth potential in Forex trading.

Leverage: Maximizing Potential with $500

In the Forex market, leverage plays a pivotal role, especially for traders with limited capital. Essentially, leverage allows traders to control a larger position with a smaller amount of money. The leverage provided by brokers can vary significantly, with some offering ratios as high as 500:1. For a trader starting with $500, this means the potential to control a position worth up to $250,000. While this might sound enticing, it also amplifies the risk of substantial losses. Therefore, understanding and responsibly managing leverage is crucial for traders, especially those operating with a comparatively modest initial capital like $500.

Risk Management: Navigating Forex with $500

Effective risk management is the bedrock of successful Forex trading. For those entering the market with $500, this becomes even more critical. The key lies in not overexposing oneself to the market with oversized positions, even if the leverage available could make it seem feasible. A prudent approach is to limit exposure to a small percentage of the trading capital for each trade. This strategy enhances the likelihood of survival and gradual growth in the highly volatile Forex market. Using stop-loss orders judiciously is another cornerstone of risk management, helping to cap potential losses and protect the trading capital.

The Growth Potential of a $500 Investment

Though starting with $500 in the Forex market may appear limiting, it holds substantial growth potential if approached with discipline and a well-thought-out strategy. The compounding effect, where gains are reinvested to generate more gains, plays a significant role in the growth trajectory of such an investment. With a focus on achieving consistent, small percentage gains, rather than making large, risky bets, a $500 capital can grow over time. It's crucial for traders to maintain realistic expectations, recognizing that while Forex trading offers opportunities for lucrative returns, it also comes with risks, especially for the undercapitalized trader.

The journey of Forex trading with $500 is not only about maximizing profits but also about learning, adapting, and evolving as a trader. Each trade, win or lose, offers valuable insights, contributing to the trader's experience and skillset. This iterative process of continuously refining strategies, based on both successes and setbacks, is essential for long-term success in the Forex market.

Navigating the Forex market with a starting capital of $500 demands a strategic mindset, disciplined risk management, and a commitment to continuous learning. While the challenges are undeniable, the opportunities for growth and learning it presents are immense. As traders progress, the insights gained from starting small can lay the groundwork for more significant ventures in the future, making the initial $500 investment a foundational step in one's Forex trading journey.

Transitioning to the next section, we'll explore "Technology’s Impact on Forex Trading," delving into how technological advancements have revolutionized trading strategies, access to information, and the overall landscape of the Forex market.

Technology’s Impact on Forex Trading

In the ever-evolving landscape of the foreign exchange market, technology has played a pivotal role in shaping both the accessibility and functionality of Forex trading. The advancements in this field have fundamentally transformed how individual traders and large financial institutions operate, offering tools and platforms that enhance decision-making, risk management, and market analysis. Understanding the depth of technology's impact on Forex trading is essential for both seasoned traders and newcomers navigating this complex marketplace.

The Democratization of Forex Trading

One of the most significant breakthroughs brought about by technology is the democratization of Forex trading. Gone are the days when currency trading was the exclusive domain of large financial institutions and professional traders with deep pockets. Today, with the advent of online trading platforms and sophisticated mobile apps, anyone with an internet connection and a relatively small amount of capital—such as $500—can participate in the global currency markets. This has not only increased the volume of trades but also the diversity of participants, lending the market a level of dynamism and volatility previously unseen.

Enhanced Analytical Tools

The development of advanced analytical tools represents another cornerstone of technology's impact on Forex trading. Traders now have at their disposal a plethora of software that can perform complex market analysis, execute automated trades based on pre-defined criteria, and simulate trading strategies using historical data. These tools have made it easier to identify trends, assess market sentiment, and make informed decisions, thereby increasing the chances of executing profitable trades. Moreover, the ability to backtest strategies before risking actual capital has allowed traders to fine-tune their approaches with a higher degree of accuracy and confidence.

Real-time Information and Global Connectivity

Technology has obliterated the barriers of time and geography in Forex trading. Through real-time data feeds, traders can now monitor the markets around the clock, react instantaneously to breaking news, and capitalize on opportunities that arise from economic developments anywhere in the world. Additionally, the global connectivity fostered by the internet means that traders are no longer isolated. Online forums, social trading platforms, and virtual communities provide avenues for sharing strategies, insights, and experiences, further enriching the trading experience.

Risk Management and Security Enhancements

The advancements in technology have also introduced more sophisticated risk management tools, enabling traders to better protect their investments. Features like stop-loss orders, which automatically close a position once it reaches a certain loss level, and leverage caps, which limit the amount of borrowed capital, help traders manage their exposure to risk more effectively. On the security front, encryption technologies and secure authentication methods have made online Forex trading platforms safer, providing peace of mind in an environment where security concerns were once paramount.

Looking Ahead: Artificial Intelligence and Machine Learning

As we peer into the future, it's evident that artificial intelligence (AI) and machine learning (ML) are set to revolutionize Forex trading further. These technologies promise to enhance predictive analytics, refine algorithmic trading strategies, and personalize the trading experience to an individual’s style and preferences. The potential for AI and ML to process vast amounts of data at unprecedented speeds could lead to even more accurate market forecasts and a deeper understanding of the complex dynamics at play in the Forex market.

In summary, technology has irrevocably altered the landscape of Forex trading, democratizing participation, enhancing analytical capabilities, providing real-time global connectivity, improving risk management, and bolstering security. As technology continues to evolve, so too will the opportunities and challenges it presents to Forex traders. Staying abreast of these changes and leveraging the latest tools and platforms will be crucial for anyone looking to succeed in this dynamic and competitive arena.

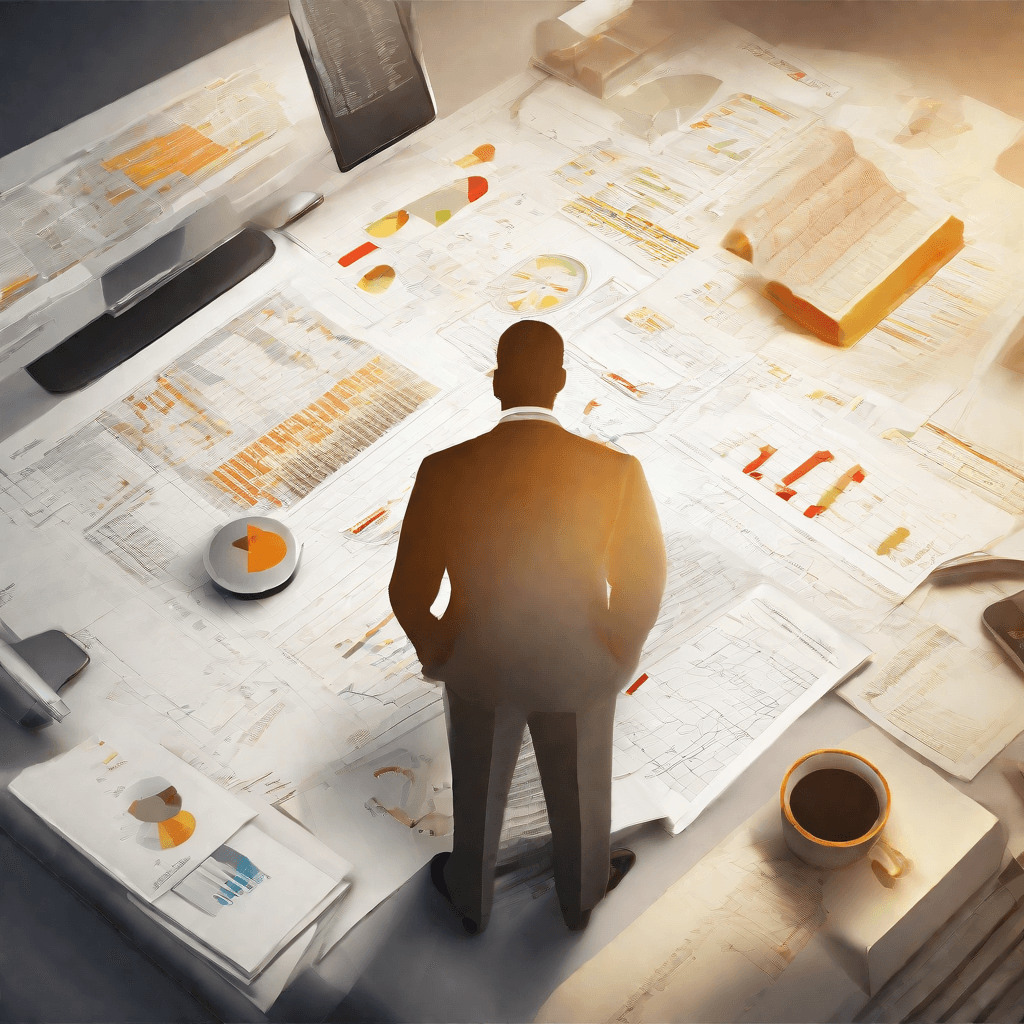

Business Insights for Aspiring Forex Traders

The realm of Forex trading offers unparalleled opportunities for financial growth and personal development. But, to navigate these waters successfully, a deep understanding of the market's mechanics, alongside a keen insight into the broader business landscape, is indispensable. In this segment, we delve into essential business insights that every aspiring Forex trader must grasp to not only survive but thrive in this competitive arena.

Embracing the Market's Volatility

The Forex market is notorious for its high volatility, which, while daunting, presents a wealth of opportunities for those adept at reading and reacting to market signals. Understanding economic indicators, geopolitical events, and monetary policies becomes crucial. For instance, a keen eye on the Federal Reserve's interest rate decisions can provide predictive insights into currency movement. Successful traders convert such volatility into strategic opportunities, positioning themselves to profit from fluctuations rather than falling victim to them.

Strategic Planning and Risk Management

The difference between seasoned traders and novices often lies in their approach to risk management. A solid business plan for Forex trading should include clear objectives, investment strategy, and an unwavering commitment to stop-loss orders. This disciplined approach helps protect your investment from sudden market reversals. Moreover, diversification across currency pairs can spread risk, ensuring that a loss in one position can be offset by gains in another.

Leverage: A Double-Edged Sword

Leverage in Forex trading allows traders to control large positions with relatively small capital. However, it amplifies both profits and losses. Effective leverage management requires understanding the balance between potential returns and acceptable risk levels. Aspiring traders should start with lower leverage ratios to get accustomed to the market dynamics before exploring higher leverage options judiciously.

The Psychological Edge

Trading is not just about strategy and knowledge; it's also a test of psychological resilience. Emotional control, patience, and the ability to remain objective are paramount. Successful traders develop a mindset that helps them make informed decisions without the interference of emotions like fear or greed. This psychological edge can often be the defining factor between making a profit or incurring a loss.

Continuous Learning and Adaptation

The Forex market is continually evolving, driven by changing economic landscapes and technological advancements. Aspiring traders need to commit to lifelong learning, staying updated with financial news, market trends, and trading technology. This includes understanding the impact of algorithms and automated trading platforms on market dynamics, as discussed in the previous section titled "Technology’s Impact on Forex Trading."

Moreover, networking with other traders and participating in forums or online communities can provide valuable insights and exposure to different trading styles and strategies.

Economic Understanding and Analysis

A thorough understanding of economics, both macro and micro, lays the foundation for successful Forex trading. Currency values are directly tied to national economies, and thus, traders need to analyze economic reports, inflation data, and employment figures amongst other indicators. This not only helps in predicting market movements but also in understanding the long-term trends that shape the global financial landscape.

Each of these insights bridges the gap between theoretical knowledge and practical application, guiding aspiring traders through the intricacies of the Forex market. By adopting a comprehensive approach that encompasses market analysis, risk management, psychological fortitude, and continuous education, individuals can navigate the Forex arena with greater confidence and competence. In doing so, they transform volatility into opportunity, leveraging their insights to build a robust trading career.

Conclusion

As we conclude our comprehensive exploration into the world of forex trading, particularly with the question of whether $500 is a sufficient initial investment, it's crucial to synthesize the insights garnered through our journey from the fundamentals of forex trading to strategic business insights tailored for aspiring traders.

The forex market, characterized by its volatility, liquidity, and 24/5 operations, presents a unique landscape for investors. Understanding this environment is critical, and as we've detailed in our series, the right approach, tools, and mindset can significantly enhance the potential for success, even with a starting capital as modest as $500.

The Power of Leverage and Risk Management

One of the pivotal topics we've dissected is the dual-edged sword of leverage. Leverage in forex allows traders to control large positions with a relatively small amount of capital, amplifying both potential profits and losses. Here, risk management strategies such as setting stop-loss orders, managing position sizes, and understanding market conditions become indispensable. For traders embarking on their forex journey with $500, mastering these principles isn’t just beneficial—it’s essential.

Educational Investment and Continuous Learning

We’ve also emphasized the importance of viewing your initial capital not just as trading funds but as an investment in education. The forex market is dynamic, with economic indicators, geopolitical tensions, and market sentiment influencing currency values. Continuous learning through market analysis, understanding the impact of global events on currencies, and keeping abreast of economic news can bolster your trading strategy and decision-making process.

The Importance of a Scalable Strategy

Developing a scalable trading strategy that can adapt to your growing expertise and increasing capital is crucial. Start with simple strategies, focusing on one or two currency pairs to avoid information overload and enhance your market understanding. As your confidence and capital grow, you can explore more complex strategies and diversify your currency pairs, thereby spreading risk and tapping into new opportunities.

Psychological Resilience

Forex trading is not just about strategies and analysis; it's equally about psychological resilience. The emotional rollercoaster of trading—experiencing wins and losses—can be taxing. Cultivating a mindset that views losses as learning opportunities and not allowing emotions to drive trading decisions is vital for long-term success.

The Community Aspect

Finally, the value of community cannot be overstated. Engaging with forums, attending webinars, and even considering mentorship opportunities can provide insights, foster learning, and offer support. The collective wisdom of experienced traders can illuminate paths that solo learning might not reveal.

In summary, while starting forex trading with $500 is indeed possible, it demands a disciplined approach, a commitment to education, and an unwavering focus on risk management. The journey from a novice to a proficient forex trader is paved with challenges, but also with opportunities for growth and success. By harnessing the right strategies, adopting a continuous learning mindset, and approaching trading with resilience, your initial $500 investment can be the seed that grows into a fruitful trading career.

Remember, success in forex trading isn’t solely measured by the size of your initial investment but by the depth of your market understanding, the robustness of your strategies, and your ability to adapt to the ever-changing market landscape. As you step forward, carry the insights and knowledge you've gained, and view every trade as a step towards mastering the art and science of forex trading.